From BUSINESS NEWS DAILY By Dock David Treece

An income statement can help you better understand the overall financial health of your business. Here’s how to prepare an income statement.

- Income statements should provide a holistic view of a company’s financial health, including revenue, expenses, losses, and profits.

- Income statements are needed for both internal decision making and external deals, such as securing financing.

- Proper preparation of an income statement is key to ensuring the report reflects an accurate picture of the business’s financial state.

- This article is for small business owners and professionals who want to learn how to properly draft an income statement for a company.

Preparing an income statement involves compiling a list of revenue, expenses, losses and gains. Once these items are consolidated, they’re organized into categories and added together to calculate net income over the time period covered by the statement.

When compiling an income statement, it’s important to make sure the right items and categories are included. Otherwise, business owners can’t get an accurate picture of a company, department or business line’s financial health for the time period in question.

There are several items that are worth paying special attention to when preparing an income statement. Different companies handle these items differently, and how they’re addressed will have a big impact on the insights gleaned from an income statement:

- Interest expense

- Tax expenses

- Depreciation of property or equipment

- Amortization (write-downs in value) of business property

If these items sound familiar, it’s because they’re often singled out to be added back to net revenue. The resulting figure is called Earnings Before Interest, Taxes, Depreciation and Amortization (“EBITDA”) and is often considered a more accurate representation of a company’s profitability than its net income.

What is an income statement?

An income statement is a financial report that shows all revenue and expenses of a company, department, team or operation over a set period of time. The reports are easily prepared using most accounting software, which allows users to select specific items to be included or excluded based on client, payee, category or various tags.

In addition to showing revenue and expenses by category, income statements also include the net income (revenue minus expenses) of the organization over a set period of time.

Most accounting software also allows users to select the types of income and expenses to be included. This lets managers customize reports to get the most accurate and insightful view of their company’s finances.

Key takeaway: Income statements are reports used to show all revenue and expenses of a company.

When and why are income statements used?

Income statements are regularly used by company managers for reporting purposes. And, depending on a company or business owner’s circumstances, they can also be used for other purposes such as valuing a business or vetting potential tax strategies.

Some other cases when income statements are used include:

- Reviewing company financials

- Making management decisions, such as hiring

- Contemplating investment in new assets

While there are lots of cases where income statements can be extremely helpful, there are also cases where people think they’re used, but they aren’t really.

Most notably, when filing taxes, income statements aren’t really necessary. They can be used by company owners or managers to get a high-level view of how much they may owe, but tax filings are prepared using custom forms, rather than categorized income statements. These filings need to be verified using third-party documentation such as bank statements.

So, when preparing tax filings, accountants usually look directly at account statements, rather than internal accounting reports like income statements.

Tip: When filing taxes, income statements aren’t typically used.

How to write an income statement

Income statements can be customized in order to suit the particular needs of a company, team, department or manager. That said, there is a general process of organizing revenue and expenses that must be followed when preparing an income statement. Otherwise, managers aren’t guaranteed to compile the right records in the right format to provide insights into an organization’s profitability.

The four steps of writing an income statement are:

- Identify sources of revenue, as well as gains (from investments, for example)

- Identify company expenses and losses incurred over the same period

- Consolidate revenue, expenses, gains and losses by category, payee or another factor

- Add up revenue, expenses, gains and losses to determine the company’s net income for the covered period

Preparing an income statement is much easier with accounting software. Most off-the-shelf accounting software allows users to easily generate income statements by simply selecting the type of accounting report they want to build and then identifying the revenue and expense categories they want to include or exclude from their report.

What is included in an income statement?

An income statement includes all instances of money flowing into or out of a company (revenue and expenses), as well as instances of the company making or losing money without cash changing hands (such as the value of business assets rising or falling). Essentially, an income statement includes all items that, when added up, equate to a company’s net income over a set period of time.

The following are included in an income statement:

- Revenue by category

- Expenses by category

- Company gains on the value of assets

- Losses incurred over the same period

From these, managers can use accounting software to calculate the net income for the time covered, which is also listed on the statement. Statements may also include intermittent totals at different points (operating revenue, income before taxes, etc.). Statements may also include net income as a percent of gross revenue (profit margin).

Example of an income statement

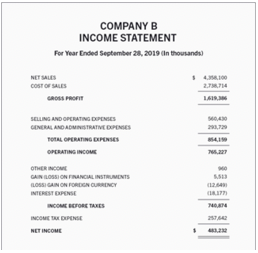

Example Income Statement

As seen in the example above, income statements begin by naming the company, team or department that the statement covers, as well as the time period covered by the statement.

Income statements then go on to list the organization’s revenue for the time period covered, as well as its expenses. There’s then a total for operating income over the period. Non-operating revenue is then added in, as well as gains and losses and interest expense.

Once these items are added in, managers can see the company’s income before taxes. Then, there’s a line item for tax expense, before finally arriving at net income. This total represents the money made or lost over the period covered by the statement.

While many income statements list totals for each of the items included, certain items can also be broken out into further detail (revenue can be broken out by business line, for example) if doing so provides valuable insight to managers.

Income statement template

Free Download: Create an income statement in minutes using our free income statement template.

This template of an income statement may be useful for those looking to assemble a report manually. But, if you have accounting software that you use for your business, you likely won’t need it. Instead, you should be able to open your accounting software and generate a custom report that includes the items you want included in your calculations to determine net income for the period being reviewed.